The year 2022 was unlike any other.

It is no wonder that the financial markets have veered into unchartered territory, with investors holding their collective breaths to see what will happen next, as they attempt to look for opportunities in the markets, however rare they might be.

After enjoying decades characterised by bullish performance across the majority of asset classes and only short and slight market corrections, the world is now contending with a significant slowdown in markets globally.

Here is a recap of events that occurred in 2022 that had the biggest – and potentially longest-lasting – impact on the markets, traders, and investors.

War in Ukraine and Global Response

Despite repeated warnings from intelligence agencies since late 2021, Russia’s invasion of Ukraine on 24 February 2022 came as a shock for the majority of the world. For the rest of the year, this conflict was an ever-present spectre in the background, and at times coming to the fore.

Beyond the condemnation of Russia, the global community led by the West implemented harsh sanctions designed to hurt Russia’s economy and its ability to sustain military operations.

Russia was also cut off from Swift [1], the system used by banks internationally to transfer money, and assets of Russian tycoons with ties to Russian President Vladimir Putin were seized.

These consequences pale in comparison with the impact the war had on energy markets, given Russia’s position as the world’s second largest crude oil producer and major exporter to Europe – and Germany in particular [2].

Havoc in the Energy Markets

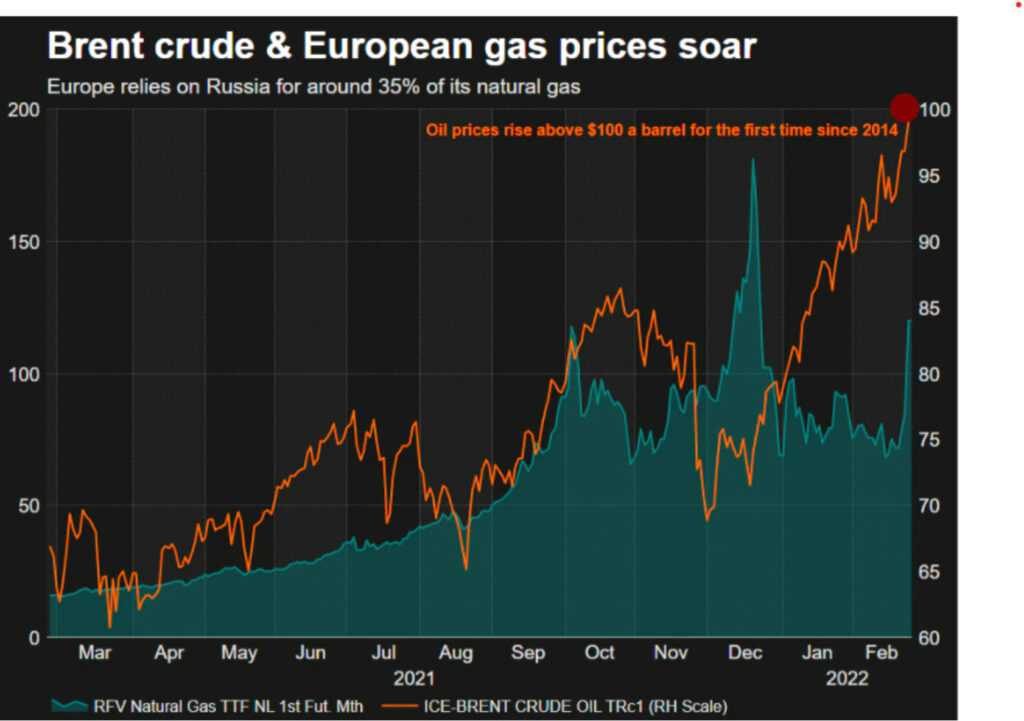

On the back of concerns that the Ukraine conflict will disrupt energy supplies, crude oil prices surged past USD $100 a barrel for the first time in a decade, with natural gas prices spiking by more than 40% in the early days of the conflict.

By the end of 2022, crude oil prices have fallen to roughly the same level as they were at the beginning of the year. These events have certainly provided plenty of volatility for traders to hunt for returns.

Rising Inflation and Interest Rates

During the early days of the COVID-19 pandemic, countries all around the world disbursed huge sums of money in order to keep businesses afloat and cushion the pandemic’s economic impact on their citizens.

Injecting huge amounts of cash into the economy has its consequences, and everyone knew that the only question is when will the time of reckoning be. Turns out, the answer is in 2022.

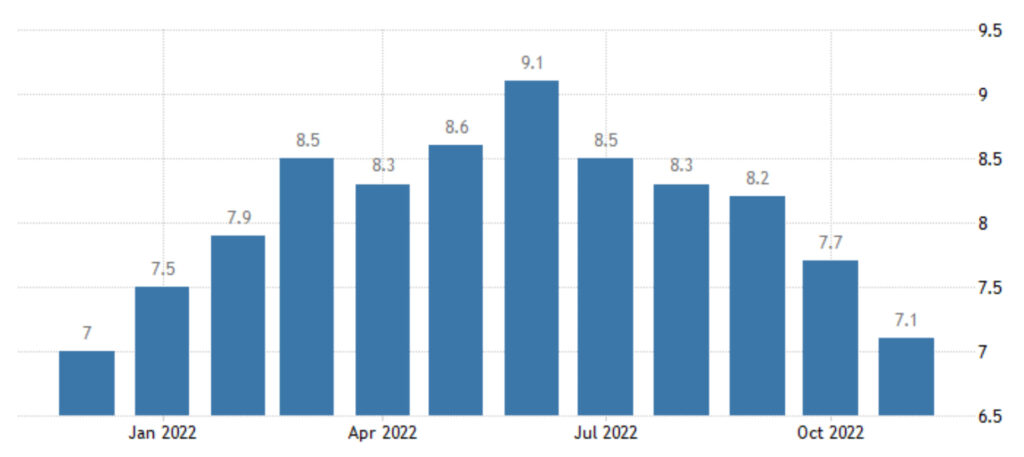

Since the start of the year, inflation in the United States (and around the world) has steadily increased. In response, the US Federal Reserve has steadily and decisively raised interest rates, while signalling their appetite to keep rates ‘higher for longer’.

High interest rates has the effect of reducing demand in the economy, increasing the cost of doing business, and dampening the outlook for companies large and small.

For instance, the S&P500 has lost 17% since the start of the year, with similar trends being mirrored in other major stock indices.

Amidst an expectation of continued economic slowdown (if not an outright recession), many investors sought safety in assets like bonds and commodities, though rising interest rates have made the value of bonds issued previously fall. This has made buying in bonds and other fixed-income assets a tricky affair and yielded mixed results for investors [3].

Golden Parachutes

As a traditional safe haven asset, gold has more or less performed in the way economists have predicted. They held their value amidst plunging or volatile markets, providing a stable and secure hedge for investors’ portfolios.

For more insights and the latest on how gold is performing, you can refer to our continued coverage on Vantage’s academy.

Even though commodities like precious metals have been a historical hedge against inflation, their performances in 2022 have also suffered, owing to the expectation that slowdowns in the global economy will lead to weaker demand for raw materials in the foreseeable future. For example, the Franklin Gold and Precious Metals Fund is down about 20% from the start of the year.

Crisis in Crypto

As if lukewarm demand for cryptocurrencies over the preceding months (in favour of Non-Fungible Tokens (NFTs) and metaverse offerings) was not bad enough for cryptocurrency enthusiasts, the year 2022 dealt two more blows.

The first came in the form of the Luna, which crashed in May 2022 [4] under dubious circumstances, much of which is still under active speculation today. Prior to this, stable coins were regarded as safer alternatives to other cryptocurrencies due to their less volatile nature. The Luna meltdown changed all of that.

The second blow to the cryptocurrency space came in November 2022 when revelations first surfaced about the balance sheet of FTX, the world’s second largest cryptocurrency exchange. This sparked a selloff that led to frozen deposits, bankruptcy proceedings, and the arrest of FTX founder, Sam Bankman-Fried.

These events have shaken confidence in the cryptocurrency space, and left everyone wondering what the next cryptocurrency crisis may be. For instance, the Fidelity Crypto Industry and Digital Payments ETF has lost more than 60% of its value from the start of the year.

Tailor Your Trading and Investment Approach Based on Your Time Horizon

Many of the risk factors that contributed to a lacklustre 2022 still loom on the horizon as we enter 2023. Hence, many investors are more cautious than optimistic. Furthermore, it is worth remembering that these factors are only the ones we know about.

If recent years have taught us anything, it is that black swan events might be more common than previously thought, and we need to always account for ‘unknown unknowns’, be they natural disasters, social upheaval, business decisions, or geopolitical events.

On the bright side, there could also be the advent of technological advancements, research breakthroughs, or coordinated efforts among governments or companies that have a huge positive impact on society, the economy, and the financial markets.

As we look towards the new year, traders and investors would do well to remain disciplined and continue to study the markets in order to find opportunities to take actions today – for a better tomorrow.

References

- “What Does Russia’s Removal From SWIFT Mean For the Future of Global Commerce? – FP”. https://foreignpolicy.com/2022/03/08/swift-sanctions-ukraine-russia-nato-putin-war-global-finance/. Accessed 26 Dec 2022.

- “Oil Market and Russian Supply – IEA”. https://www.iea.org/reports/russian-supplies-to-global-energy-markets/oil-market-and-russian-supply-2. Accessed 26 Dec 2022.

- “After a Terrible Year for Bonds, the Outlook Is Better – NY Times”. https://www.nytimes.com/2022/12/09/business/bond-market-economy-investing.html. Accessed 26 Dec 2022.

- “What Really Happened To LUNA Crypto? – Forbes”. https://www.forbes.com/sites/qai/2022/09/20/what-really-happened-to-luna-crypto/. Accessed 26 Dec 2022.