An Exchange-Traded Fund (ETF) is a type of investment fund that tracks the performance of a basket of securities.

It offers investors and traders a way to gain exposure to multiple different securities according to sector, asset classes, geographical regions and even investment styles – without having to find, own and manage several individual stocks and shares on their own.

Given the flexibility and utility they offer, it isno surprise that that ETFs are a highly popular choice among investors worldwide, and are regularly offered by online brokerages and investment firms. Some brokerages even offer 0% trading fees for ETFs.

However, that doesn’t mean that ETFs do not come with costs. ETFs have what is known as an expense ratio, which is essentially a fee you pay to the fund manager.

Here’s a detailed explanation of what the expense ratio of an ETF is, how it is calculated, and how it impacts trading opportunities and potential returns.

What is an expense ratio?

ETFs are offered by investment firms who hire fund managers to structure the fund. The fund managers are responsible for selecting the underlying equities, commodities, indices or other securities that make up the ETF, in accordance with its stated investment objective.

To cover the work required to research and structure the ETF (as well as marketing, advertising and other associated costs), fund managers charge a fee. This is the expense ratio.

Incidentally, ETFs aren’t the only investment products with expense ratios. Mutual funds, too, come with expense ratios.

How are expense ratios calculated?

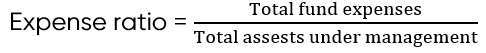

The expense ratio for an ETF is expressed as a percentage. It is calculated by the following formula:

Because of the way it is calculated, expense ratios for ETFs are typically a small figure; indeed, it is common for ETFs to have expense ratios of under 1%, and going as low as under 0.1%

However, investors should still pay attention – that small figure represents the annual cost of owning the ETF, and could have large implications on your overall returns.

In other words: Consider an ETF with an expense ratio of 0.5%. This means that for every $1,000 invested, you’re paying $5.

Note that expense ratios aren’t deducted from your account every year, like how a regular fee works. You also won’t see expense ratio fees appearing on your statement.

Instead, the expense ratio is deducted by the fund manager on a daily basis, with corresponding adjustments made to the fund’s Net Asset Value.

Here’s what that means in practice. Let’s assume that you have $20,000 invested in an ETF with an expense ratio of 0.5%.

If the ETF makes a return of 0% that year, your portfolio value will slowly decrease to $19,800 over the course of a year.

How do the expense ratios of ETFs impact you?

An ETF expense ratio can be deceptively small, and it is important to understand the potential implications on your portfolio.

Let’s illustrate with a hypothetical example.

Assuming we have a principal sum of $10,000, invested into an ETF growing at 7% each year. What would your total portfolio be worth over time, and how do different expense ratios affect the outcome?

Using an online calculator [1], we derived the following figure:

| Portfolio value (0.5% expense ratio) | Portfolio value (1% expense ratio) | |

| Year 1 | $10,650 | $10,600 |

| Year 5 | $13,700.87 | $13,382.26 |

| Year 10 | $18,771.37 | $17,908.48 |

| Year 20 | $35,236.45 | $32,071.35 |

As you can see, what starts out as a negligible difference grows into a sizable sum over the years. Even worse, the rate of change accelerates over time.

By Year 20, the ETF with the higher expense ratio would have delivered 8% lower returns than its lower-cost counterpart.

And, here’s how much you’d have paid to own the ETF:

| ETF total cost (0.5% expense ratio) | ETF total cost (1% expense ratio) | |

| Year 1 | $50 | $100 |

| Year 5 | $342.65 | $643.26 |

| Year 10 | $900.14 | $1,763.04 |

| Year 20 | $3,460.39 | $6,625.49 |

The figures in both tables highlight that expense ratios should not be taken at face value, and should be carefully evaluated, especially if you’re planning to hold ETFs over a long period of time.

What’s a good expense ratio?

As a rule of thumb, the lower the expense ratio, the better – it means you will be able to retain more of your returns and pay less in fees.

However, a low expense ratio does not automatically render an ETF a worthy investment, especially if the potential returns are low.

Expense ratios must be considered in the context of the return of the fund. Consider that an ETF with an expense ratio of 0.5%, with an annual return of 4%, will provide lower returns than an ETF with an expense ratio of 0.8%, and an annual return of 7%.

This is because in the former, the expense ratio takes up 12.5% of the returns, whereas in the latter, the expense ratio takes up 11.4%.

Additionally, expense ratios for ETFs may be impacted by several different factors, such as category of investments, investment strategy use, and the size of the fund.

A fund with a smaller amount of assets usually has a higher expense ratio due to its limited pool available for covering costs, whereas a fund with a larger market capitalisation can offer a lower expense ratio.

Similarly, international funds can have high operational costs because they may require staffing in several countries, leading to higher expense ratios than a similar ETF operating locally.

The good news is, ETFs expense ratios have been falling over the past two decades. A 2021 report by Morningstar found that the asset-weighted average expense ratio across all mutual funds and exchange-traded funds was 0.4%. This is less than half of what investors paid in average fund fees in 2001. [2]

2021 asset-weighted average fees

To evaluate an ETF expense ratio, it is helpful to compare it against what other investors are paying.

Here’s a summary of the average expense ratio paid by investors in 2021, on an asset-weighted basis.

Note: “Active” refers to ETFs that are actively managed (i.e., fund managers constantly monitor, trade and make changes to the fund’s holdings, instead of letting the fund track the underlying securities on autopilot, as passive ETFs do).

| ETF category | Active (%) | Passive (%) |

| U.S. Equity | 0.63 | 0.08 |

| Sector Equity | 0.79 | 0.26 |

| International Equity | 0.72 | 0.18 |

| Taxable Bond | 0.47 | 0.09 |

| Allocation | 0.59 | 0.44 |

| Alternative | 1.10 | 0.65 |

| Commodities | 0.60 | 0.37 |

Start investing in ETFs with Vantage

Now that you have an understanding of how Expense Ratio works in ETFs, get started with an account to trade CFDs on ETFs, now available on Vantage.

References

- “Expense Ratio Calculator – Omni Calculator”. https://www.omnicalculator.com/finance/expense-ratio. Accessed 20 Sept 2022.

- “Investors Piled Into the Cheapest Funds in 2022 – Morningstar”. https://www.morningstar.com/funds/fund-fees-continued-decline-is-win-investors. Accessed 20 Sept 2022.