What is the most well-known gauge for measuring how the economy of a country is performing? The strength of its currency gives us a picture, but may be influenced by speculators and liquidity, while bond markets are normally considered a little complex for the general public to understand to any professional level.

The vast majority of people turn to the performance of a country’s stock market index as the best indicator of how well that economy is doing and to gauge market movements.

Indices generally cover industries across all sectors of the economy. That means they serve as a barometer of what cycle the economy is in and the hopes and fears of the population who generate growth and wealth.

Of course, indices now are very different from the first share trading in the Dutch East India Company back in 1602. But they still remain one of the most popular investment choices as they are the main public, regulated marketplaces where people can buy and sell a group of shares of different companies. The potential for returns and their opportunity to invest easily in a broad cross-section of the economy broadens their appeal.

Today, stock market indices have developed into a trillion-dollar industry. They serve as benchmark comparisons for numerous uses across markets.

The most popular indices will play a major role in the new year in helping investors understand how the biggest economies in the world are performing.

Recap of the overall 2023 Indices Market outlook

Global stock indices showed strong performance in 2023, surprising many who expected lacklustre returns given the weak macro backdrop and the widely held view that a recession would hit economies through the year. Instead, markets proved highly resilient, recovering from hard landing fears that had fed into the October 2022 lows, as well as geopolitical tensions.

Performance was dominated in the US by a handful of megacap technology companies that were propelled by their above average earnings and the mania surrounding artificial intelligence (AI). These were dubbed the “Magnificent Seven”, a new nickname with parallels to previous stock market darlings like the dot-com stocks of the late 1990s.

This group makes up over one quarter of the benchmark US S&P 500 index with collective gains of over 70% on a capitalisation-weighted basis. Five of the seven are part of the rare trillion-dollar club with the most recent entry, Nvidia, being the best performer, with scorching returns of over 230%.

More recently, their spectacular growth has been attributed to the increased expectation that the Federal Reserve, along with other central banks, will begin reducing interest rates earlier than expected in the next few months. The lingering strength of US consumers also stabilised growth and sustained the resilience of the economy.

Indices Market Outlook for 2024

US Market Outlook

With the hoped-for “soft landing” now in view, inflation is expected to cool further towards the Fed’s 2% target without significant damage to the labour market and a recession. This should provide some upside potential in earnings as interest rates fall and in turn, support stock valuations. But threading the needle to deliver a soft landing would be a historical exception amid a deteriorating growth outlook.

Money markets currently discount the Fed cutting rates by nearly 1.5%, starting as early as March. This is forecast to help drive double-digit earnings growth. The investment bank JP Morgan has looked at soft landings going back to 1965 and believes the S&P 500 typically rallies by roughly 15% on average in the 12 months after the first rate cut [1].

But the indices will also have to contend with a US election in November as they enter 2024 with volatility near historical lows. The US stock indices may continue to command a premium over others due to the cash-rich megacap tech companies and the sector composition of the indices. The fate of the Magnificent Seven will be central, having accounted for nearly two-thirds of the benchmark index’s gains in 2023. Their size and competitive advantages could make them a refuge amid any economic fallout.

UK Market Outlook

The major UK stock market index, the FTSE 100, dramatically underperformed the US and other global indices in 2023. The lack of growth and tech companies is key as the UK is dominated by interest rate sensitive companies like banks and homebuilders. Oil majors, energy and mining companies also feature heavily, so the commodity cycle is crucial.

This does mean the UK index is attractively valued, with a multiple of around 10 times earnings, which is a third lower than global equities and some 15% below its long-run average. The FTSE 100 produces an earnings yield of 9.2% that implies its solid dividend yield of 4%+ a year is covered a healthy 2.3 times by earnings [2]. This might be attractive to investors in 2024.

The value of the pound could drive some of the major heavyweight companies in the index which generate most of their revenues from overseas. UK elections loom and geopolitical concerns linger which means the more defensive weighting of old economy stocks may benefit the index if these worries increase.

Europe Market Outlook

European stock markets generally performed well in 2023, beating the broader global indices with growth far better and inflation much lower than feared. The direction of travel of the economic data going into the new year is also potentially more encouraging than the US.

Earnings expectations for 2024 are muted in the eurozone indices so that leaves more upside on the multiple front from potentially lower interest rates. If the economy does recover, and China as well, bearish investor sentiment could reverse. The case becomes compelling too when looking at valuations as Europe’s indices trade at a major discount to the US. Even adjusted for sector differences, such a valuation divergence is unprecedented.

China Market Outlook

Economic growth is expected to stay around 5% in 2024 on the back of more fiscal expansion and potentially some monetary easing if it is needed to hit the GDP target. Deleveraging and changes to the economy that are less reliant on property are needed to entice back foreign investors. They dumped more than $25 billion of shares last year, which put net purchases by offshore investors on course for the smallest annual total since 2015.

The Asia market (CSI 300) has outperformed the offshore index for the last five years. Any rate cuts or further currency weakness would likely see this continue. The property market overhang could mean volatility remains a key characteristic in stock indices in 2024. But high-quality growth stocks with strong earnings who are less reliant on government policy support might help minimise this. Suppressed earnings estimates would be boosted by an improved geopolitical outlook.

Asia Pacific Market Outlook

Japanese stocks outperformed global equities in 2023 as elevated inflation saw major efforts to improve profitability and corporate governance. Demographic changes and a generally weakening currency also combined to act as tailwinds for stocks. The long-held undervaluation of the market has only been modestly corrected, which means many Japanese equities still trade at a big discount to their global counterparts going into 2024.

The process of structural reforms is ongoing and allied with a still-inexpensive currency, is expected to see overseas flows enter stock indices. Policy changes by the Bank of Japan could affect the yen with a stronger currency is historically seen as a negative for the export‑driven Japanese economy. But positive earnings momentum and the potential for repatriated flows by domestic investors is likely. The Topix is expected to be led by sectors recovering from the cyclical slump.

Mid-Year Review and Future Outlook for the Markets

As we cross the midpoint of 2024, let’s take a detailed look at the trends and developments shaping financial markets around the world.

Mid-Year Review and Future Outlook for the US Market: 2024 Trends and Projection

As we move into the second half of the year, let’s review the performance and significant updates in the market thus far.

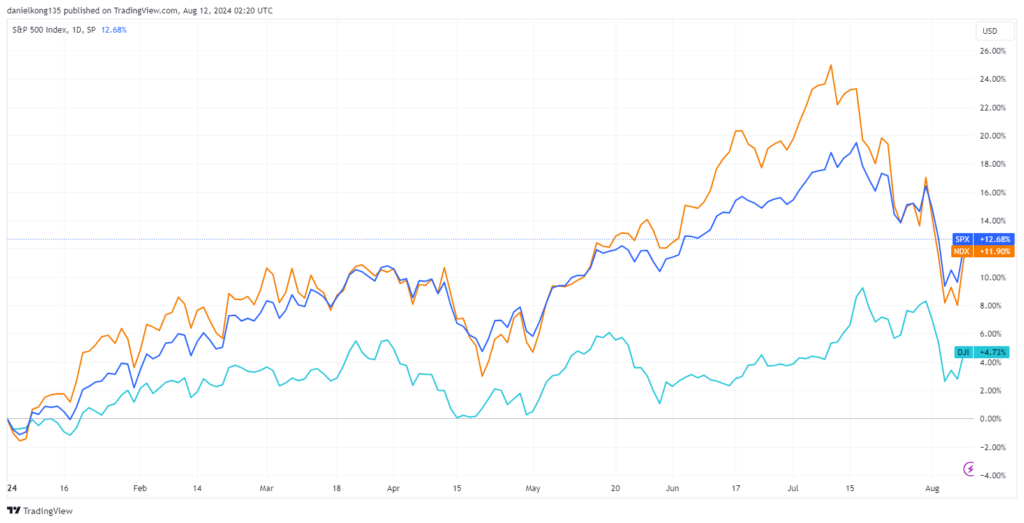

Chart 3: Graph of S&P 500, Nasdaq 100, and DJI from 1 January 2024 – 9 August 2024 (https://www.tradingview.com/x/ZrG7oc0b/)

Throughout the year, both the S&P 500 and Nasdaq 100 have achieved new all-time highs. In July, the S&P 500 reached a peak during intraday trading on 16 July 2024, hitting 5,669.67 before settling at 5,667—marking its 38th record of the year [3]. Similarly, the Nasdaq 100 reached its zenith on 10 July 2024 with a high of 20,690.97, closing slightly lower at 20,675.38 [4]. These gains were largely propelled by the excitement surrounding AI stocks and the influence of major tech giants, often referred to as the ‘Magnificent Seven’.

In contrast, the Dow Jones Industrial Average (DJI) has not performed as well, primarily due to its minimal exposure to technology stocks compared to the S&P 500 and Nasdaq 100. The Dow experienced a distinct pullback in the second quarter, falling 1.7%, while the S&P 500 and Nasdaq saw increases of 3.9% and 8.3%, respectively, during the same period [5]. Nevertheless, the DJI still managed to reach a record high close of 41,198.08 on 17 July 2024 [6].

After closing at their respective highs, the markets started to trend downwards and faced a significant downturn on 5 August 2024. The Dow Jones Industrial Average (DJIA) fell by 2.6%, while the broader S&P 500 dropped by 3% and the tech-focused Nasdaq declined by 3.43% [7]. These drops extended a week of losses, with the S&P having already lost 9% since hitting its record high on 16 July, while the Nasdaq has shed 14% since its record high [8].

Discover more about the major market crash in August by visiting the Vantage Academy.

Mid-Year Review and Future Outlook for the UK Market: 2024 Trends and Projections

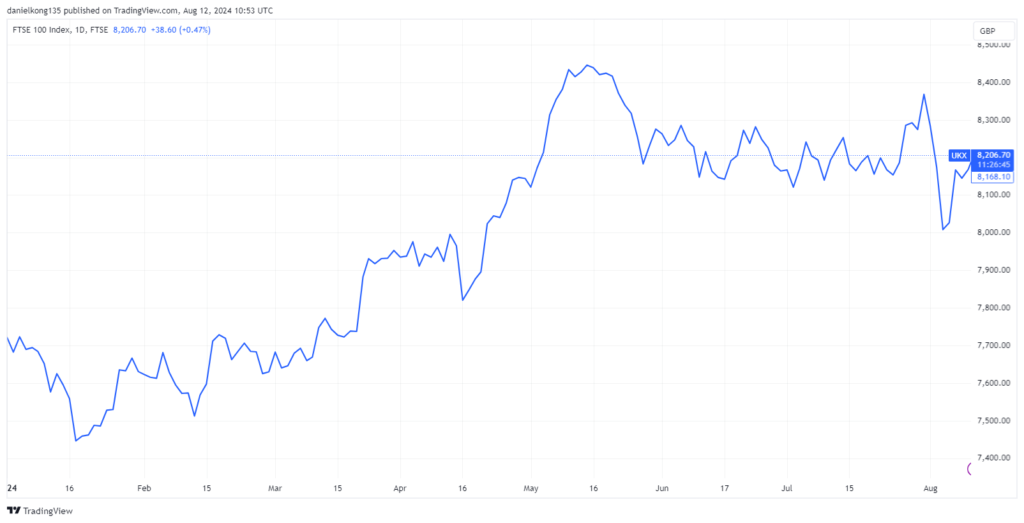

Chart 4: FTSE 100 Index from 1 January 2024 – 9 August 2024 (https://www.tradingview.com/x/oQ6tf8C7/)

The FTSE 100 showcased a strong upward trend during the first half of the year, peaking at an intraday high of 8474.71 on 15 May 2024 before settling at 8445.80 [9]. This surge was driven by easing inflation in the UK and anticipation of a rate cut by the Bank of England.

In May 2024, UK inflation hit the Bank of England’s target of 2% for the first time in almost three years, a sharper decrease compared to the Eurozone and the US, where inflation rates were 2.6% and 3.3% respectively [10]. Despite concerns last year about persistent high inflation in the UK, these fears were allayed by the recent figures.

However, the market faced a setback following an unexpected announcement by former UK Prime Minister Rishi Sunak about the general elections set for 4 July 2024. The FTSE experienced a period of sideways trading until it briefly rallied again following the Bank of England’s decision to cut interest rates to 5% on 1 August 2024. This was the first reduction in over four years, providing temporary support to the market [11].

The recovery was short-lived as a disappointing US employment report in August revealed slower job growth and an increase in unemployment to its highest in nearly three years. This news led to a sharp decline in the FTSE 100, which closed above the 8,000 point mark on 5 August before gradually regaining its earlier losses [12].

Mid-Year Review and Future Outlook for the China Market: 2024 Trends and Projections [13,14,15,16]

Chart 5: CSI 300 Index from 1 January 2024 – 9 August 2024 (https://www.tradingview.com/x/AeMf1Ea8/)

The year 2024 saw the CSI 300 index begin with a slump, only to reverse into an upward trajectory by February, culminating in a peak on 20 May when it reached an all-time high of 3,690.96. This rally was primarily fuelled by several strategic manoeuvres by the Chinese government aimed at stabilising the market.

Notably, the state’s visible intervention through entities like Central Huijin Investments, which increased its holdings in major ETFs and mainland bank stocks, played a critical role. This bolstered investor confidence, drawing a clear line of support in the otherwise volatile market environment. The government’s openness about these purchases marked a shift from previous, more discreet actions, signalling a robust commitment to maintaining market stability.

However, post-May, the index experienced a downward trend, reflective of broader global economic uncertainties and internal market pressures. Despite this decline, the fundamentals of the Chinese market have been strengthening, as evidenced by strategic policy supports such as the State Council’s “9 Key Points” aimed at improving China’s capital markets.

These initiatives have encouraged a healthier IPO environment, better dividend practices among listed companies, and improved corporate governance—factors likely to enhance investor confidence in the long term.

Since the high in May, the CSI 300 has been trading downward, but signs of revitalisation are visible as policy measures and renewed investor interest hint at a potential stabilisation or uptick as the year progresses.

Mid-Year Review and Future Outlook for the Asia Pacific Market: 2024 Trends and Projections

Chart 6:Nikkei 2245 and Topix Index from 1 January 2024 – 9 August 2024 (https://www.tradingview.com/x/RSKp4peQ/)

Since the beginning of the year, the Japanese stock market has seen a robust upward trajectory. In 2024, the Nikkei index achieved remarkable milestones, setting new all-time highs. Notably, it reached an intraday and closing high of 42,426.77 on July 11, 2024, surpassing the record set back in 1989 [17]. Similarly, the Topix index also closed at a record high of 2,929.17 on the same day, breaking a 34-year-old record established in December 1989 [18].

This bullish trend was primarily driven by significant gains in technology stocks, spurred by advancements in artificial intelligence (AI) and semiconductor technologies. The Japanese market has attracted considerable interest from both foreign and domestic investors in recent months, despite a slowdown in the broader economy.

This surge in investment is partly due to the depreciation of the Japanese yen, which is at its weakest in 34 years against the dollar. The weak yen enhances the value of dollar-denominated profits for Japanese exporters when these earnings are converted back into yen.

But all good things must come to an end, and the Japanese market was no exception. On 5 August 2024, the dynamics shifted dramatically due to the unwinding of yen carry trades, which had previously bolstered the market. This financial strategy, heavily utilised by investors, involves borrowing yen at low interest rates to invest in higher-yielding assets globally.

However, a sudden spike in the yen’s value, triggered by an unexpected interest rate hike by the Bank of Japan, rendered these trades less profitable and led to massive losses. Investors rushed to close out their positions, exacerbating the selloff. Consequently, both the Topix index and the Nikkei 225 experienced their most severe drops since the Black Monday crash in 1987, plunging 12% each on that Monday [19].

Explore our detailed article on carry trade and its effects on the financial markets.

Conclusion

A weaker global economy is set to influence share prices and stock market indices. Resilient major US tech stocks could still be a safe bet as they represent solid growth in a probable low-growth world. But the high concentration of previous gains could make the indices more vulnerable to overcorrections. Investor sentiment elsewhere is lower, especially in Europe, so there is a greater potential for positive surprises.

Geopolitics and a year full of elections will create headlines, none more so than the US duel which could be a deeply polarising campaign. The second half of the year could be dominated by this, with major implications for policy and market indices.

In summing up the indices market outlook for 2024, it’s clear that while the shadow of a complex global economy looms, indices remain a key guide for investors and analysts alike. The unexpected strength of last year’s markets suggests a complex interaction between big economic trends and market sentiments.

As we navigate through political, economic, and technological shifts, the performance of these indices will continue to serve as both a mirror and a forecast of global economic health. Whether buoyed by technological giants or swayed by geopolitical winds, the indices will undoubtedly continue to be at the heart of financial narratives, shaping and reflecting the world’s economic story.

References

- “2023 in review: Rates, rallies and reflections – JP Morgan” https://www.jpmorgan.com/insights/outlook/market-outlook/2023-in-review-rates-rallies-and-reflections Accessed 29 Dec 2023

- “What I learnt about the FTSE 100 in 2023 – The Motley Fool” https://www.fool.co.uk/2023/11/15/what-i-learnt-about-the-ftse-100-in-2023/ Accessed 27 Dec 2023

- “S&P 500’s $18 Trillion Rally Is ‘Broadening Out’: Markets Wrap – Bloomberg” https://www.bloomberg.com/news/articles/2024-07-15/stock-market-today-dow-s-p-live-updates Accessed 12 August 2024

- “Market Close Report: Historical high reached as NASDAQ Composite Index closes at 18,647.45 – Nasdaq” https://www.nasdaq.com/articles/market-close-report-historical-high-reached-nasdaq-composite-index-closes-1864745 Accessed 12 August 2024

- “S&P 500 closes lower Friday, but AI trade drives a 14.5% gain in first half of 2024: Live updates – CNBC” https://www.cnbc.com/2024/06/27/stock-market-today-live-updates.html Accessed 12 August 2024

- “Stock Market News for Jul 18, 2024 – Nasdaq” https://www.nasdaq.com/articles/stock-market-news-jul-18-2024 Accessed 12 August 2024

- “Dow tumbles 1,000 points, S&P 500 posts worst day since 2022 in global market sell-off: Live updates – CNBC” https://www.cnbc.com/2024/08/04/stock-market-today-live-updates.html Accessed 12 August 2024

- “Markets give off ‘Black Monday’ vibes as stocks tank – Reuters” https://www.reuters.com/markets/us/global-markets-milestones-graphic-2024-08-05/ Accessed 12 August 2024

- “Housing stocks push FTSE 100 to a record close – Reuters” https://www.reuters.com/world/uk/ftse-100-hits-record-high-experian-boost-us-cpi-tap-2024-05-15/ Accessed 12 August 2024

- “UK inflation drops to 2% target for first time since 2021 – Reuters” https://www.reuters.com/markets/europe/uk-inflation-returns-target-first-time-since-2021-2024-06-19/ Accessed 12 August 2024

- “Bank of England cuts rates from 16-year high, will be ‘careful’ on next moves – Reuters” https://www.reuters.com/markets/europe/bank-england-cuts-rates-16-year-high-will-be-careful-next-moves-2024-08-01/ Accessed 12 August 2024

- “FTSE 100 Live 5 August: ‘Markets in meltdown’ but index holds 8,000-point mark; Bitcoin sinks – Yahoo! Finance” https://sg.finance.yahoo.com/news/ftse-100-live-5-august-054647487.html Accessed 12 August 2024

- “Why is China’s Recent Market Rally Different? – OrientFutures” https://www.orientfutures.com.sg/LG-cn/post-detail/Why-is-China%E2%80%99s-Recent-Market-Rally-Different Accessed 12 August 2024

- “Chinese Stock Rebound Has Many Hallmarks of More Enduring Rally – Bloomberg” https://www.bloomberg.com/news/articles/2024-05-10/chinese-stock-positives-are-growing-as-these-four-charts-show Accessed 12 August 2024

- “5 Reasons China’s Recent Stock Market Rally is Fundamentally Different – KraneShares” https://kraneshares.com/5-reasons-chinas-recent-stock-market-rally-is-fundamentally-different/ Accessed 12 August 2024

- China market leads gains in Asia as it extends 8-month highs after holding key lending rates steady – CNBC” https://www.cnbc.com/2024/05/20/asia-markets.html Accessed 12 August 2024

- “Japan’s Nikkei hits all-time high, tops 42,000 on Wall Street gains – The Business Times” https://www.businesstimes.com.sg/companies-markets/japans-nikkei-hits-all-time-high-tops-42000-wall-street-gains Accessed 12 August 2024

- “Japan’s Nikkei smashes past 42,000 mark to all-time highs as Asia markets rally on rate cut optimism – CNBC” https://www.cnbc.com/2024/07/05/japan-stock-markets-hit-record-highnikkei-topix-rally-sustainable-.html Accessed 12 August 2024

- “Japan’s $1.1 Trillion Stock Meltdown Rewrote the Record Books – Bloomberg” https://www.bloomberg.com/news/articles/2024-08-06/japan-s-stock-meltdown-was-so-epic-it-s-rewritten-record-books Accessed 12 August 2024